Written by: Samira Fatehyar

Synopsis

As more economic data comes out, we are starting to see a better picture of the economic damage the Covid-19 pandemic has caused. The May unemployment numbers came out and spurred a lot of debate. We also witnessed a major rally in the stock market that shocked many, but came to a quick end with the Dow Jones falling almost 7% in one day. The Fed’s bleak economic forecast dampened the market as well. The NBER (National Bureau of Economic Research) determined that the US officially entered into a recession in February. The OECD (Organization of Economic Co-operation and Development) released a preliminary economic outlook highlighting a decrease in growth globally for at least the next two years. Another big story that came out this week was that the US’s national debt has increased by $2 trillion in 2 months. I examine the effects of all of this and try to make sense of what it means for the average American.

Unemployment Data

Introduction

On the first Friday of June, official May unemployment numbers were released. They were positive numbers and it sent Wall Street into a euphoric rally. But they weren’t as positive as you might imagine. The BLS (Bureau of Labor Statistics) had a rather large footnote in their release stating that there was a misclassification error that should have resulted in unemployment numbers being higher than they actually are. I will get back to that in a bit, but first I want to remind everyone that we are still witnessing record level unemployment rates that many of us have never experienced in our lifetimes. This is not something that will magically disappear overnight. This will be a long recovery. Many sectors were struggling pre-Covid 19 and as I have stated in the past, Covid-19 has acted as an exogenous catalyst that moved everything faster in a negative direction.

Chart 1, below, shows the unemployment rates the BLS has published.

Looking at Chart 1, we can see the U-3 unemployment rate, or the official unemployment rate, being 13.3% for May 2020. This means that the unemployment rate fell 1.4%, which is great news, but it also makes sense as more and more sectors of the economy start reopening. This, coupled with the $1,200 stimulus checks, are being praised as the right medicine to cure unemployment. Unfortunately, this will only go so far, again I will explain this in a later section. The real unemployment rate that most economists look at is U-6 which shows 21.2% unemployment, a 1.6% decrease from April. Again, this is great news, but it makes sense, so nothing too mysterious to report there. Although, I will point out again, these are substantially high numbers and not ones we are used to ever seeing, so we must not brush it off. Tens of millions of Americans are still unemployed!

Job Creation by Sector

The BLS also reported that 2.5 million jobs were created in May. I wanted to take a moment and list out the sectors that reported job growth during May.

According to the BLS, Leisure and Hospitality employment increased by 1.2 million, Constructionemployment increased by 464,000, Education and Health Services employment increased by 424,000, Retail Trade employment increased by 368,000, Manufacturing employment increased by 225,000, Professional and Business Services employment increased by 127,000, Financial Activities employment increased by 33,000 and Wholesale Trade employment rose by 21,000.

Many of these sectors had furloughed their employees in hopes that they would be able to rehire them at a later time. Now, we can get into a semantics tangent about whether being furloughed and returning to your job after a period of time equates to job creation or not. On the surface, I would say no, but I know many would argue that this could have easily gone the other way and these jobs could have been lost. I just think the word “creation” should be taken with a grain of salt, especially in these times when the economic impacts of the pandemic are having never before seen affects.

Misclassification Error

The big story that made headlines was the footnote the BLS put on their employment report. They stated that there was a misclassification error that should have resulted in a 5% increase to the unemployment numbers of April and a 3% increase to the unemployment numbers of May. That means that the April unemployment rate should have been 19.7% and the May unemployment rate 16.3%. Granted, this was an improvement but still higher than what is being reported.

What was this misclassification error? It was the fact that many people had been classified as employed but “absent” from work for “other reasons,” when in fact, they should have been classified as temporarily unemployed. This category was applied to those waiting to be called back into work. It should be noted that the “other reason” category is used, in normal times, for those taking a leave to care for a relative or a child, vacation, or jury duty. I will give credit to the BLS since we have never seen a pandemic in our lifetimes and not knowing exactly what to classify someone as during these times is quite understandable. That being said, I do hope they revise their previous numbers to reflect the true unemployment rate. Another thing I want to point out is those saying that the Trump administration somehow doctored these numbers, this is just a blatant lie. Regardless of where you stand on the political spectrum, I can tell you economists do their absolute best to make sure data is unbiased and I expect nothing less coming from the BLS. Here is the link to read the report yourself.

Wall Street

The Rally (June 5th-9th)

Although I’ve already spoiled the unemployment data for you, Wall Street had seemed to ignore everything and believe that the unemployment numbers were fantastic news and a sign that we are in a rapid recovery. I, along with many other economists, including the Federal Reserve chairman, do not believe this to be true. So why did Wall Street behave this way? Granted, the rally came to an end the Tuesday after, but why did the rally occur?

A former Pepperdine professor of mine, Dr. Clemens Kownatzki, shared a powerful graphic he created in which he showed over the course of 16 years or so, the S&P 500 shifting weights of each stock. In more recent times, there has only about 10 stocks that carry the majority of the weight of the entire index now. Video 1, below, shows the animation he created to illustrate the point.

Let’s take a step back and define what a market index is. From the SEC, it specifies that, “a market index tracks the performance of a specific “basket” of stocks considered to represent a particular market or sector of the U.S. stock market of the economy.” The S&P 500 is a composite price index and represents 500 stocks. Now, using the SEC’s definition to look at the above animation a few things should pop out at you. If a market index focuses on a basket of stocks, 10 individual stocks should not be able to throw the entire index one way or another. The top 10 stocks in the S&P 500 carries a 26% weight of the entire index. If it is not an equally weighted index, then each stock is not equally represented. The point is that we shouldn’t have let it get to this point in this index. Granted, we tried to control what was happening, but these tech stocks kept rising and increasing their market cap.

Professor Clemens Kownatzki provided some very intriguing insight on why he believes this is happening. He suggests that the arrow of causality has been reversed. I’ve already explained what ETFs are and how they work, but I think it’s important to note that about 50% of the money that is in the market is invested in ETFs. If you take a look at SPY, or the ETF for the S&P 500, you can see the vast amount of transactions made per day makes it extremely liquid. Traditionally, news coming out from a company would send a signal to the stock market about that individual stock, which would then affect the entire index, one way or another. But now we have people buying ETFs which then affects the index instead of individual companies doing that. I found that point extremely interesting and thought I would share it with you all.

Another reason we keep seeing the markets continue to rise is because of the Federal Reserve’s actions. The Fed has contributed to the rise of zombie companies, or companies that are failing due to solvency issues but are kept alive by the Fed in various ways. This goes back to a previous blog post about how this will lead to a different market landscape, as many companies will not try to strive for excellence but will instead feel as though they will always receive a bailout, no matter what strategies they put in place. This leads to laziness but most troubling moral hazard.

The Subsequent dip (June 10th-11th)

What we witnessed on June 11th was very similar to what we saw 3 months ago on March 16th. The Dow Jones fell 6.9% in one day. Though, not enough for the circuit breakers to be triggered but awfully close. Now what does it mean? Many of the tech stocks were down during this period as well.

Chart 2, above, shows the Dow Jones Industrial Average’s performance during the week of June 8th-12th. As you can tell, there was a massive drop seen this week. We are still down 5.6% for the week. I included this chart to show the magnitude of the drop. Economists don’t usually like to focus on the short term, so I decided to also include a year to date graph of the Dow Jones, which is in Chart 3, located below.

I wanted to show this graph because, although the Dow Jones is down 10.04% for the year, the dip we saw last week, was nowhere near what we saw in March.

Many attribute this crash to the Covid-19 number of cases in the US as well as Jerome Powell’s bleak forecast. I will get into the forecast in a bit. Many have stated that it Wednesday and Thursday’s dips were due to investors having a “gut check” of the market. Covid-19 numbers are rising in many states and some areas are considering reinstating stay at home orders where other officials have stated they will not close again. Other analysts have said that the market reaction we saw on Thursday was due to the Fed’s inaction and to keep interest rates the same. Either way, it was a big reaction and one that should not be ignored.

The VIX or the volatility index, is a great tool for investors and economists to see where the market is headed. Higher volatility relates to higher risks and more uncertainty in the market, whereas lower volatility relates to lower risks and less uncertainty in the market. Chart 4, below, shows the VIX over a 1-year time period.

As we can see in Chart 4, the volatility we saw in March was astronomical in comparison to previous months. Even now, we are not seeing as much volatility in the market with the VIX charting in at 40.79 on June 11th and 36.09 on June 12th, basically half of what we saw in March. Granted, this is a good sign, but is still signaling to investors that everything needs to be done cautiously. If we have a second wave of Covid-19 and the economy is forced to severally close, I truly believe we will see a crash or something very similar to one. I truly hope we don’t see that, but since we still don’t have a vaccine and a proven way to fight this virus, anything is still possible.

Federal Reserve

FOMC Meeting

On June 10th, Jerome Powell and the rest of the FOMC members met to discuss their forecast for the economy as well as if they wanted to impose any sort of interest rate change. Powell stated that they are looking to keep interest rates close to zero until 2022 at the very least. This should be great news, but we are also seeing that because of this lower interest rate, not everyone will be able to borrow. Many banks are tightening their restrictions on lending to those with certain credit scores. On one hand, this could turn out to worsen the affect as those with lower credit scores may be the ones in the direst need. On the other hand, it is showing great restraint and better practices from banks, as opposed to what we observed during the Great Recession. It’s unfortunately a double-edged sword.

Jerome Powell also highlighted that he expects to see GDP growth at -6.5% for 2020. This is not as dire as other predictions but should not be taken lightly since this is a large contraction in the economy. Powell believes the unemployment rate will stay high for years and we will see a 9.3% unemployment rate by the end of 2020. He stressed that a full recovery is unlikely until consumers feel comfortable to go outside again. He went on to say that there will be a large output gap for the next 2 years.

Fed Interventionism

Powell highlighted that the Fed will continue to use all their monetary tools and to do whatever it takes to lessen the blow of the economic fallout. This is a terrible idea as it will continue to create moral hazard problems as well as the “zombification” of companies. The more we are able to let the market decide what companies fail and what companies succeed, the healthier a market we get. The Fed is coddling a lot of these companies that are insolvent; I don’t see the benefit in doing that. I do see that the Fed is now in the position that if they continue to do this, it will continue to worsen the market, and if they stop, it’ll also worsen the market. We are in the famous American dilemma where we are stuck choosing between the lesser of two evils. At the end it’s still considered evil. The point I’m trying to make is that we shouldn’t have let ourselves get to this point, no country should.

Recession

NBER

According to the NBER, the US officially entered into a recession in February, pre-lockdown, which indicates that the economy, as I have stated over and over again, was faltering before Covid-19. In the committees’ own words:

The usual definition of a recession involves a decline in economic activity that lasts more than a few months. However, in deciding whether to identify a recession, the committee weighs the depth of the contraction, its duration, and whether economic activity declined broadly across the economy (the diffusion of the downturn). The committee recognizes that the pandemic and the public health response have resulted in a downturn with different characteristics and dynamics than prior recessions. Nonetheless, it concluded that the unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warrants the designation of this episode as a recession, even if it turns out to be briefer than earlier contractions.

This is very important to recognize because as I mentioned previously, a recession usually becomes classified once we see 2 quarters of negative GDP growth. We have yet to end the 2nd quarter of 2020, and the NBER has already confirmed the recession started in February. As they stated, the pandemic has resulted in a recession we have never seen before and it may end faster than we think.

OECD

The OECD earlier last week came out with their economic outlook for 2020. It was bleak to say the least. They estimate -7.3% GDP growth if we only suffer from a first wave of Covid-19 and -8.5% GDP growth if a second wave happens. This is nothing compared to many other European countries as seen in Graph 1.

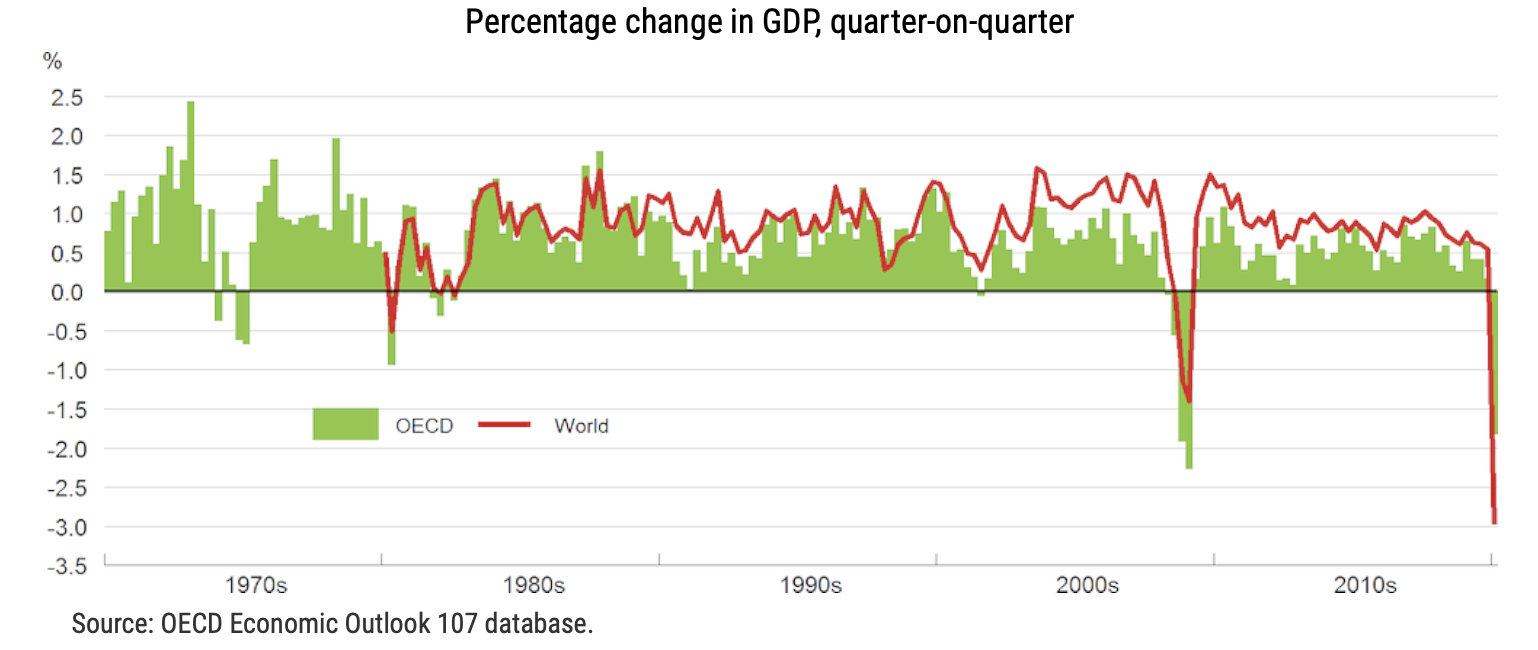

When we look at Graph 1, things don’t look as bad as they could definitely be, so this is definitely a bright side for the US. I would like to talk about things globally for a little bit though, since we are currently a very globalized economy and we do rely on what is going on in other countries. Graph 2, below, shows the percentage change in GDP for OECD countries as well as the rest of the world.

As you can see, global activity sharply fell in Q1 of 2020, more than what we saw during the Great Recession. Granted, we don’t know how long this will last but by the looks of it, there may not be a V-shaped recovery but instead a U. It is significant to point this out. Another important graphic the OECD provided in its report was that of manufacturing output PMI and service output PMI which is in Chart 4, below.

For the US, both the manufacturing and services output PMIs are lower than what was observed during the Great Recession as of April. An interesting trend to note is that all countries suffered in their services output but when it came to manufacturing the effecting wasn’t as uniform. This might suggest that some countries may be able to continue output of products while other countries will start lagging behind. This could potentially change the makeup of the global economy.

Fiscal Response

Larry Kudlow, President Trump’s top economic advisor, has been suggesting for quite some time now that the $1,200 stimulus checks given to many Americans worked great and that we need to wait 1-4 months to see the full effect of it. This is counter to what Treasury Secretary Mnuchin has advocated for which is another round of stimulus checks for Americans. Regardless of the divided statements from the White House, Jerome Powell has stated time and time again that the US government needs to provide more fiscal relief as the monetary tools he is using can only do so much. Hopefully the government chooses to do what’s right for the American people and not what’s right solely for massive corporations.

Paycheck Protection Program

PPP, or the Paycheck Protection Program, has been one of the ways the government has provided fiscal assistance to Americans. Chart 5, below, highlights the industries that received the most PPP loans. It’s important to note that this was for small businesses in each sector. I was a bit surprised when I saw this because I know the headlines are reporting that many in the food services industry were hit the hardest. As we can see below, out of the top 5 sectors, they received the least amount. Maybe many of the restaurant owners had decided to permanently close instead of applying for PPP loans, but that is just a guess to explain why it was so low relative to the other sectors.

My Take: The Rising National Debt

I think it’s always important to step back and re-assess where things are headed in anything we do. We are in the midst of both a public health crisis and an economic crisis. It was announced last week that within the last 2 months we have increased our national debt by $2 trillion. That is astronomical and there is no way the millennial generation will be able to pay off this massive amount of debt. It’ll take MANY generations to pull that off. But I’m constantly wondering if the $2 trillion has really helped lessen the blow of the economic crisis. Don’t get me wrong, it has done a lot of good, as we saw with the PPP program as well as the stimulus checks. But is $1,200 enough for someone living paycheck to paycheck in an area where the cost of living is higher than the average of the country? The effects of the Paycheck Protection Program are yet to be fully seen, though so far it’s estimated that it may have saved roughly 50 million jobs.

As of now, we are witnessing massive corporations getting bailed out and hoping that trickles down to the average American. Though there is some validity in that economic theory, I don’t think this is the best circumstance to be deploying it. Currently it looks as if the government trusts CEOs more than the average American when it comes to financial literacy. I can tell you that with the company insolvency rate we are currently witnessing, I’d say CEOs are having quite the hard time understanding their own businesses. So, if we are really worried about the financial literacy of average Americans and worried they would waste the money, well I’d rather them waste $1,200 than the millions we are giving corporations. The way I see it, anyhow an average Americans could “waste” the money could potentially help put the economy back to work. And on top of that, every American, whether or not they received the stimulus check, has to pay it back 3 times over to the government, whereas these corporations have to pay back a much smaller rate. This is all my opinion and how it currently looks to me.

Concluding Remarks

Unfortunately we’ve experienced yet another couple of weeks of uncertainty and a wild ride on Wall Street. The extent of the economic damage is worsening and won’t be stopped until a vaccine comes out. Unfortunately, even when the vaccine does come out will be the beginning of the recovery, but it won’t be a sudden recovery and that’s what I want to make sure everyone understands.

I was listening to a CBS news segment about a man willing to be part of the vaccine trials and I commend him for that. But the trail also infects those with Covid-19, which raises a lot of ethical issues. One thing I found shocking was that this man was willing to risk his life in order to lessen the economic damage for himself and future generations. Though very heroic, it makes me wonder have we come to a point where economic damage is considered worse than death? Some thoughts to ponder.

Please stay safe and healthy everyone! I will write you again in 2 weeks!